We have heard many rumors about insurance companies, but we have never personally encountered any issues in the past.

We suspected that insurance companies need to collect more money than they spend in order to be profitable, but we were far from realizing the extent of the dysfunction within the system, despite the regulations that govern them.

Recently, we were victims of a car theft, to be more precise, a Toyota CHR Hybrid. In this article, you will discover our firsthand experience with this event and the incredible turn of events due to some very questionable logistics.

The events related to the theft of our vehicle

As a reminder, the events unfolded in the following order. On 03/02/2023, we purchased a used company car. It was a Toyota CHR White Pack Graphic Premium with 36,850 km for 21,000 euros.

After searching for many months, we finally came across this very interesting offer, especially considering that this vehicle usually sells for around 23,000 euros with the same options.

On 17/03/2023, after completing the vehicle’s annual maintenance at Toyota, we parked the car in a nearby street to our home due to the lack of available parking spaces that evening.

The next day, around 4:30 PM, we discovered that the vehicle was no longer parked in its place. We immediately went to the nearest police station to report the car theft and file a police report.

The police report was sent to Olivier Assurance the next day, on Monday, along with the opening of the claim on 20/05/2023. The option to report the claim by phone was not available before this date, which, in itself, is not very serious as we did it within the legal timeframe, i.e., within 48 hours.

Our first experience with l’Olivier Assurance

We chose Olivier Assurance for two reasons. The first reason was that our previous insurance, Directe Assurance, could not insure a vehicle owned by a company. So, we decided to turn to Olivier Assurance, which was voted the best customer service of the year 2023 and had relatively better reviews on Trustpilot.

Since we had not been insured for more than 24 months, no history could be traced back. We lost any form of no-claims bonus and ended up paying exactly 1,374.73 € for one year of third-party insurance with theft coverage. The comprehensive insurance was priced at over 2,000 euros, which seemed disproportionately high compared to the fiscal power and the value of the vehicle.

The insurance premium for this vehicle was even more expensive than the one for my first car with a 150 fiscal horsepower as a young driver. We attributed this to the fact that it was insurance for a vehicle owned by a company.

Their “pack confort plus” is equivalent in price to comprehensive insurance at other insurers with physical offices like Macif.

Non existing interactions with the insurance following the opening of the case

In short, the insurance company never contacted us to guide us through the claims process. This meant that we were left to ourselves and had to constantly take the initiative to call them for updates or even to receive instructions.

We found this experience quite confusing, as after a theft, the insured person needs reassurance and clear information about the procedure and timelines. Legally, the insurance company must make a settlement offer within 30 days, and on the 30th day, you become eligible for compensation for your vehicle.

Since we had opted for the “assistance plus” option, we received a replacement vehicle for 30 days as stated in the contract. Up to that point, our experience had been relatively positive.

Unfortunately, every time we called to inquire about the status of the claim, the advisors from the claims department kept telling us that we had to wait at least 30 days for the compensation procedure to be initiated. However, this was false, as the procedure should have been initiated earlier so that we could receive our compensation after 30 days.

The advisors were lying to buy time.

It’s simple, a person named Arsène was the claims handler. I never got to speak to him on the phone.

Interactions with the biased expert designated by the insurance company

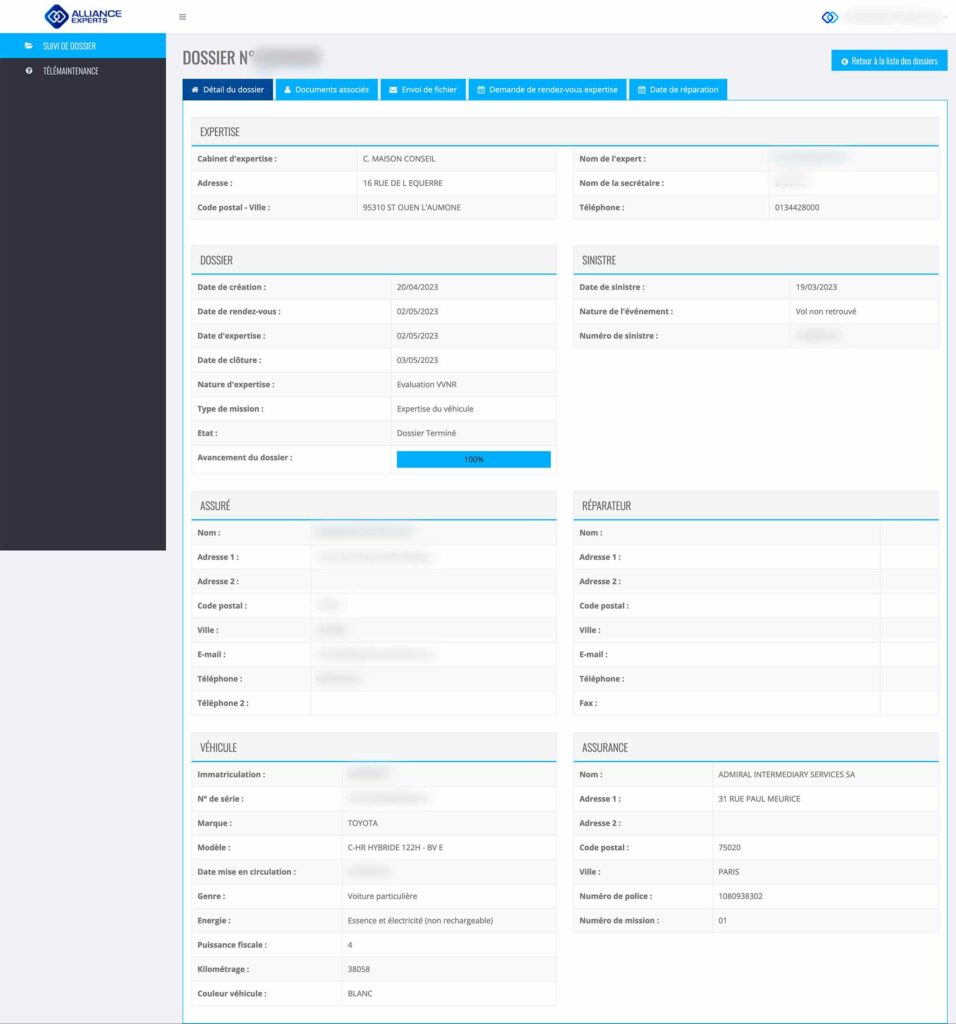

So, after 30 days, we received the list of documents to provide along with a properly filled form. We uploaded all the documents on our personal account with L’Olivier on the same day. Subsequently, and after a considerable delay, an expert from a company named Alliance Experts 95 contacted us by mail to continue the procedure.

Right from the start, it seemed extremely strange to us that it wasn’t L’Olivier asking for these documents, but another company we had never heard of, and through mail. Moreover, this company requested the retrieval of all the vehicle’s keys and a list of documents, some of which had already been sent to L’Olivier.

Biased experts

Alliance Experts 95 is an automotive expert company located in Cergy-Pontoise Cedex, France.

C. MAISON CONSEIL – S’ Ouen-L’Aumône

95042 – CERGY PONTOISE CEDEX

Phone: 01 34 42 80 00

This company, Alliance Experts 95, as indicated by the stamp, does not correspond to any company listed on the website societe.com. It either uses a different name or multiple names. Even at this address, there is another company with a different name but in the same field, with a large number of negative reviews, suggesting that the company is in collusion with the insurance company.

It appears that this company may be a branch or subcontractor of the parent company ALLIANCE EXPERTS ILE DE FRANCE or Maison conseil Christophe EXPERT, located at another address 13 Av. de la Mare, 95310 Saint-Ouen-l’Aumône.

alliance-experts.com

The entire structure seems highly suspicious. That’s why we requested the insurance company to confirm the relevant expert by email to ensure that we sent the keys to the right person.

Even L’Olivier was unable to send us an email with the correct expert, indicating how complex the structure is.

| We are reaching out to you regarding the referenced claim. Following our telephone conversation, we confirm that the expert appointed for this case is indeed “ALLIANCE EXPERTS ILE DE FRANCE.” We kindly ask you to send them the requested documents for the proper processing of your claim. If you have any further questions or require assistance, please do not hesitate to contact us. Yours sincerely, Arsene L’olivier Assurance |

Expert’s offers well below the VRADE

After a long wait, the expert finally contacted us with an initial appraisal of 19,990 euros. We were very familiar with the vehicle, and even at 21,000 euros, it was a great deal. How could they propose to compensate us with such a low amount when the same vehicle was being sold for 23,000 euros on Leboncoin?

We suspected that there were issues with the appraisal, so we called the expert who couldn’t even provide us with the correct model and package of the vehicle. This raised serious concerns, and we repeatedly asked the appraisal firm if they needed more information about the vehicle’s options. We weren’t convinced that a simple VIN would be enough for them to determine all the specific features, and we were right.

The price they offered indeed corresponded to the same vehicle but without any options on the used car market. For over a month, we negotiated with this dishonest expert. We even asked him to send us advertisements for similar vehicles at the same price. He sent us three ads, all well above the initial price of 19,990 euros, one of which was no longer in working condition, another where the actual price after fees was close to 23,000 euros, and another with customizations (tuning) and no history. They make every effort to lower the vehicle’s value as much as possible; their goal is not to find a fair market value, but to save money for the insurance company.

The expert even came back to us with an offer of 21,000 euros a few weeks later, which matched our purchase price but not the actual value of the vehicle. While this offer may seem fair on the surface, in reality, we would not be able to buy a similar vehicle at that price.

The VRADE (Vehicle Replacement at Dealer’s Price) is specifically calculated to ignore whether the buyer made a good or bad deal.

During our discussions, it was very clear to both of us that the real VRADE value was higher, but according to him, they were not legally able to compensate us for the actual value of the vehicle because we only paid 21,000 euros. This goes against the law and the decision of the Court of Cassation.

The case has been suspended pending evaluation. What shocks us the most in this situation is that the customer has only three choices:

- Accept a lower offer,

- Wait indefinitely, or

- Initiate a legal proceeding.

This is why customers must accept unfair offers in order to move on with their lives.

The most concerning aspect is that the experts are supposed to be independent and neutral from the insurance company. However, in reality, the insurance company selects its experts based on their performance, meaning their ability to reduce costs for the insurance company.

We honestly believe that the system today is flawed.

Stolen vehicle found

After a long wait on May 20, 2023, which was two months after the theft and still not having received any compensation, our vehicle was found by the police about thirty kilometers away from our home with a broken window.

Apparently, apart from the broken window, the vehicle was in a fairly similar condition to before the theft. The contents of the trunk and the baby seat were still fixed in the back. The thief had only driven about thirty kilometers and abandoned the vehicle in a residential area.

We quickly went to the local police station to obtain a recovery report. The vehicle was towed by a tow truck and stored in another town. We provided the necessary documents, including the recovery report, to the insurance company so that they could retrieve it for repairs.

What the law says

According to the law, after the 30-day period without the vehicle being found, the client has the right to claim compensation and refuse to retrieve their vehicle if it is found after this deadline. We are now in a state of indecision, trying to choose between the two options. On one hand, the vehicle has only been driven about thirty kilometers, but on the other hand, considering our experience with the reimbursement process, we no longer have confidence in the insurance company to promptly pay the VRADE amount.

Some of my acquaintances were reimbursed more than 2 years later because they had to involve a lawyer who took a percentage of the compensation as a commission.

http://www.matthieu-lesage-avocat.com/juridique/retour-de-vol-remboursement-ou-restitution-27.html

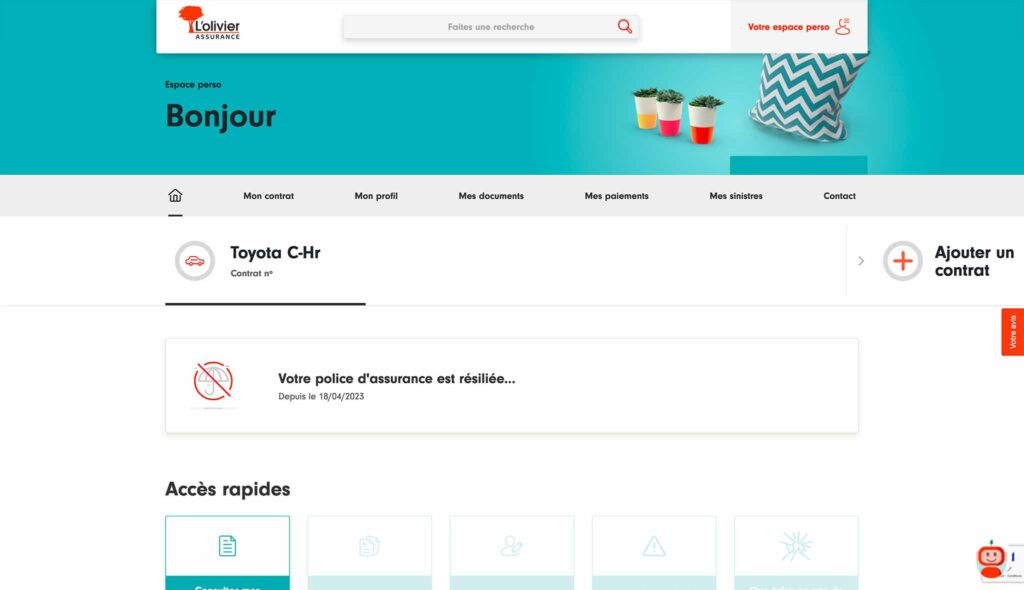

Auto insurance contract automatically terminated after 30 days

It’s important to note that when opening a claim, the insurance contract is automatically terminated after 30 days. They remain responsible for incidents that occurred during the contract period but disclaim any responsibility for anything that might happen thereafter.

Inability to reach the claims handler over the phone

Following this automatic termination, you will be unable to reach the claims handler at the number provided on the website. Each call requires you to identify yourself, and if you inquire about the progress of your claim, you will encounter the following message: “We are sorry, but your claims handler is unavailable, please address your request by email.”

This practice is highly questionable. It is akin to blocking a number from someone to whom you owe a debt. Since that day, I have to spend 15 minutes on each call going through the customer service to be transferred to the claims department. Can you imagine the difficulty of the process?

Not to mention that they have never responded to 95% of my email inquiries, and when they do, it takes two weeks or more to receive a response.

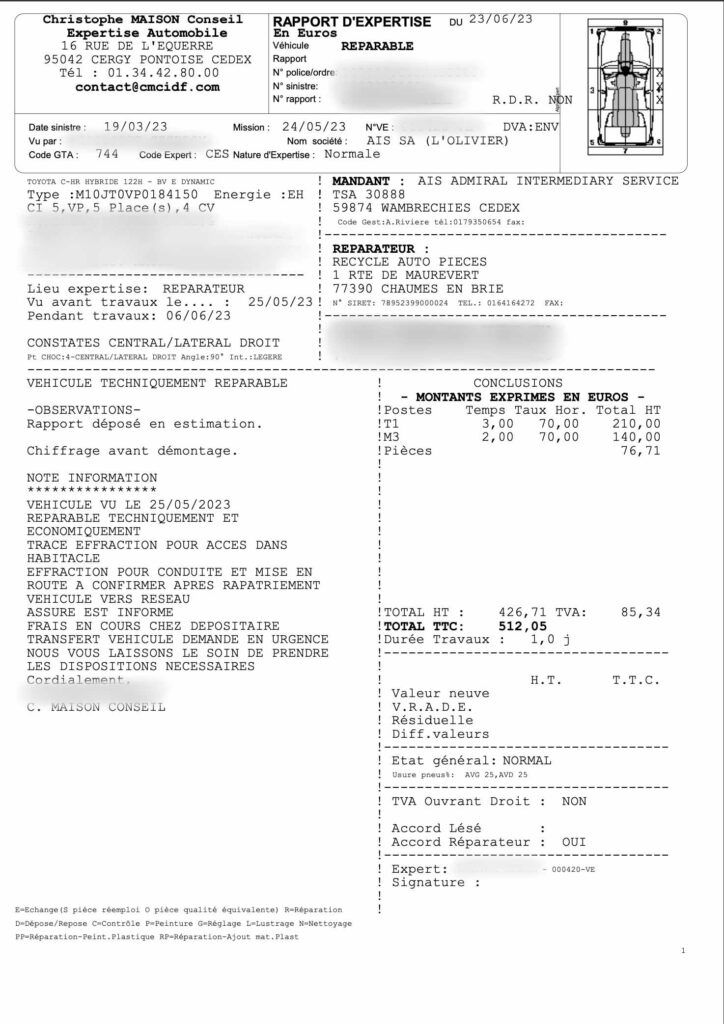

The interim report from the expert

This time, another expert from the same firm came to inspect the vehicle on-site on the 25th of May 2023, which was 5 days after the vehicle was stolen. That evening, the expert contacted me to give a brief summary of the vehicle’s condition and asked me to contact my insurance to have the vehicle moved to the garage of my choice for repairs.

We contacted the insurance company on the following Monday, as we had received the call on Saturday evening. The insurance company informed us that they were still awaiting the expert’s report and that it was impossible to initiate a repair process without this report.

Procedural stalemate

We find ourselves in a situation where we have to call the expert and the insurance company to relay information between both parties. We call the expert to inquire about the report, and he says he has sent a message to the insurance company. However, the insurance company tells us that they are still waiting for the final expert report. It turns out that the expert requires a diagnostic done at Toyota to complete his final expertise report.

Impoundment fees at the impound lot

It’s a never-ending cycle, and we are stuck in a dead end. We call every day, asking for the expertise report, and the expert sends us the temporary report. Yet, a month goes by, and the claims handler gives us the same response: “We are still waiting for the final expertise report.”

Illegal towing

In the meantime, we asked the insurer to move the vehicle to avoid storage fees, which, according to the contract, are the responsibility of the customer. However, since we didn’t have the keys to the vehicle, and it wasn’t insured anymore due to the termination of the contract, we couldn’t arrange the vehicle’s transportation ourselves as the advisors suggested over the phone.

Even the assistance service refused to move a drivable vehicle without the keys. The account manager took charge of arranging the vehicle’s transportation with a partner network and requested a resumption of the insurance contract. However, nobody took care of the resumption, and the vehicle was moved without being insured, which is prohibited by law.

A month later, the advisors told us that we needed to take out a new insurance contract as the previous one had been terminated for more than 90 days.

The insurance was never reactivated, despite my requests. This clearly shows that they knew exactly how the events were going to unfold.

Vehicle moved to an unattended junkyard without temporary securing

The insurance sends us SMS with temporary numbers like 38046, asking us to retrieve our belongings from the vehicle. Firstly, we don’t have a vehicle as it’s immobilized there, so we have to rent a vehicle at our own expense to retrieve items like a stroller and a baby car seat.

We decide to go to the location to retrieve our belongings and take the opportunity to assess the condition of the vehicle. The place is called “Recyclage pièce auto,” a scrapyard that sells used vehicle parts. It is an open area accessible to the public, and I was able to enter and retrieve my belongings for about thirty minutes without any supervision.

This, in itself, is not Autopièce’s fault, but it sheds light on the dark side of insurance practices. It means that they do not have partner garages or dedicated warehouses to handle recovered vehicles.

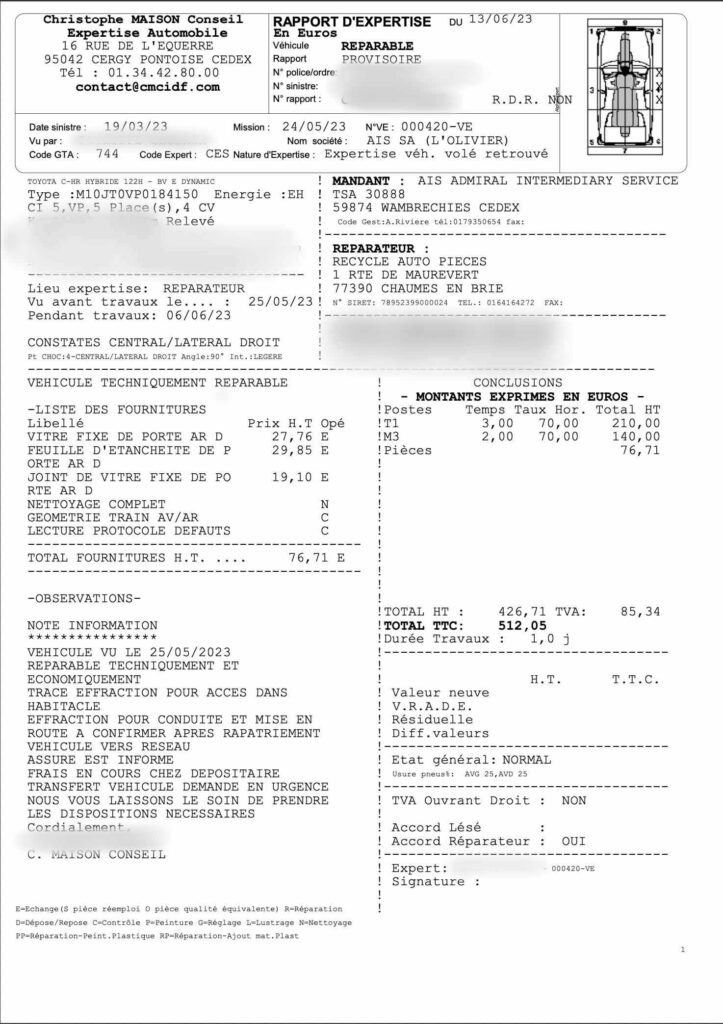

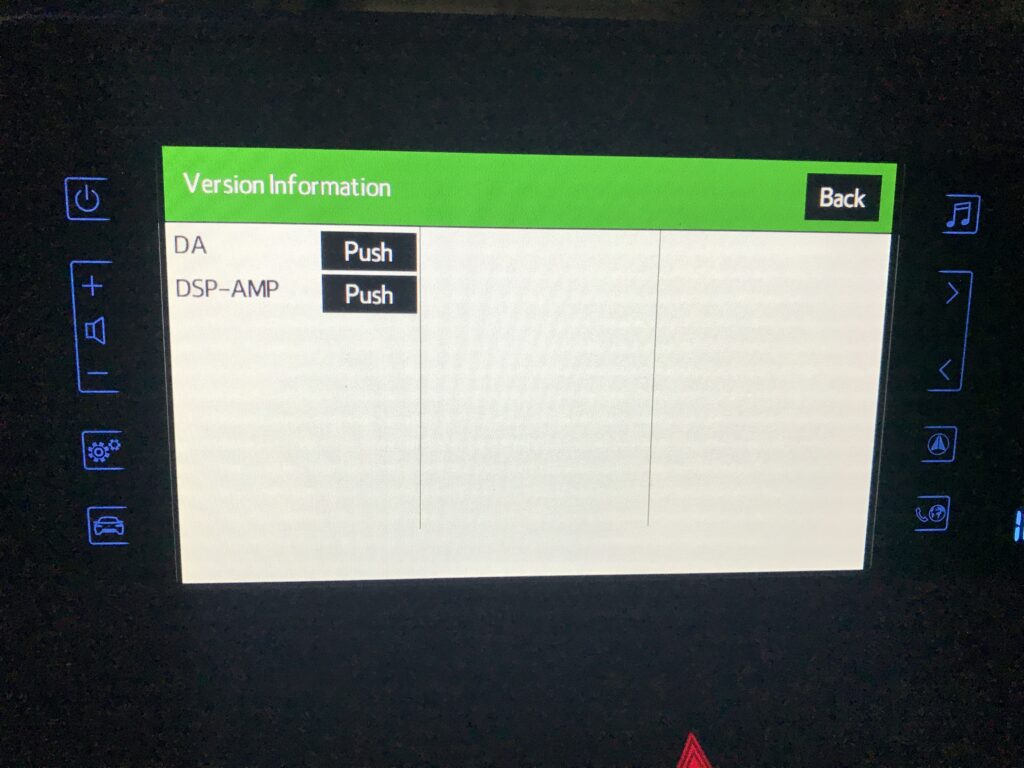

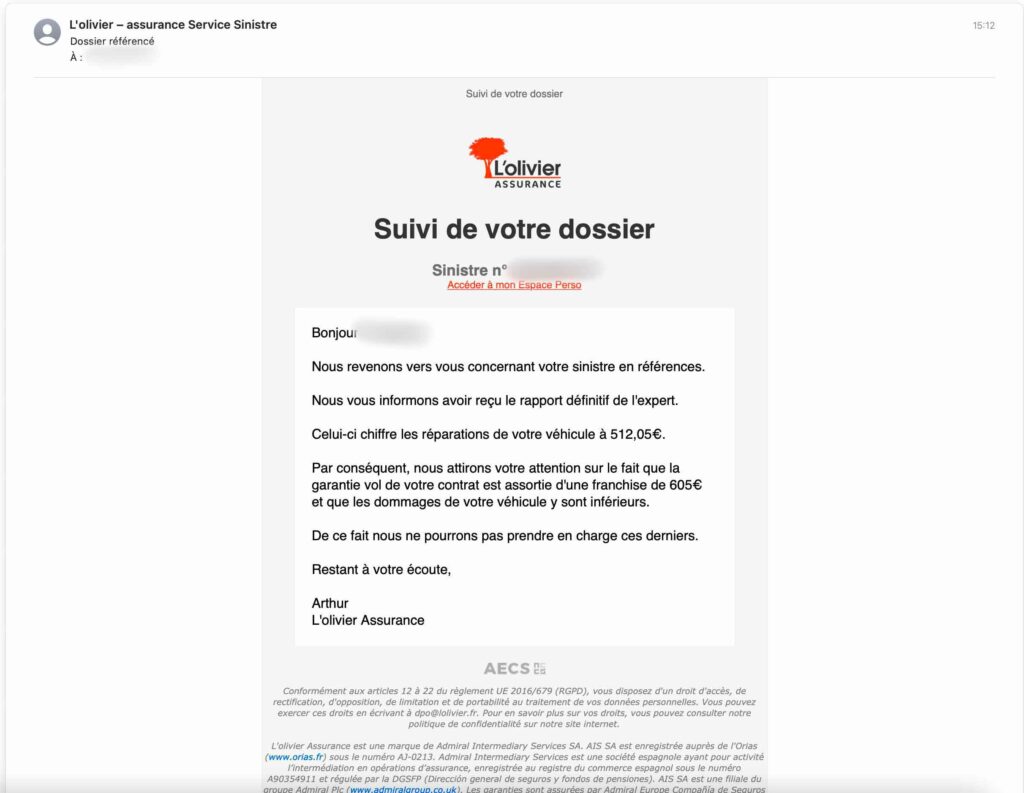

Repairs lower than the deductible cost according to the expert

Another troubling detail is that the expert, in his provisional expertise report, estimates the cost of repairs and the vehicle inspection to be lower than the deductible. When the cost of repairs is lower than the deductible, the client is responsible for repairing the damages themselves. Once again, it seems strange that the expert’s assessment aligns with the insurance company’s interests.

We spent exactly 499 € for an annual checkup at Toyota. How could it be possible that a comprehensive checkup, along with the repair of a window and the reproduction of a VIN, assuming the vehicle has no mechanical, electronic, or battery issues, would cost less than 605 euros including taxes?

This is simply impossible; the price was calculated to fall just below the deductible. The insurance company is obligated to return the vehicle to us in its state before the theft. Otherwise, imagine the troubles of getting back a stolen vehicle three months later without even replacing the window when the insurance covers glass breakage.

Due to the amount of estimated repairs being below the deductible, we will retrieve the vehicle almost two months after 08/07/23 in the same condition as it was found on 20/05/23.

This whole ordeal will have been nothing more than a waste of time and added risks of breakdown for our vehicle.

Vehicle retrieval

In addition to not receiving instructions to retrieve the vehicle, of which they estimate the costs below the deductible, L’Olivier Assurance returns your vehicle in a non-functional state.

This means that even if the battery is dead, some hybrid cables are disconnected, and the cover isn’t even closed.

We had to solve the problem ourselves to start the car, knowing that the scrapyard lent us a booster, and we had to reconnect the orange fuse to connect the hybrid battery.

You retrieve your vehicle in a state as it was found after the theft, or even worse, as it has remained in a partner scrapyard for several months.

The car has clearly been searched, including the trunk. According to them, the experts mentioned that the vehicle was non-functional, and we had to reconnect the hybrid battery, while the 12V battery was also dead.

Observations after retrieval

After retrieving the vehicle, we noticed several things that the expert completely overlooked.

- The front support for the license plate is cracked.

- The VIN (Vehicle Identification Number) under the windshield is missing.

- The front body has traces of impacts and deformations on the front bumper.

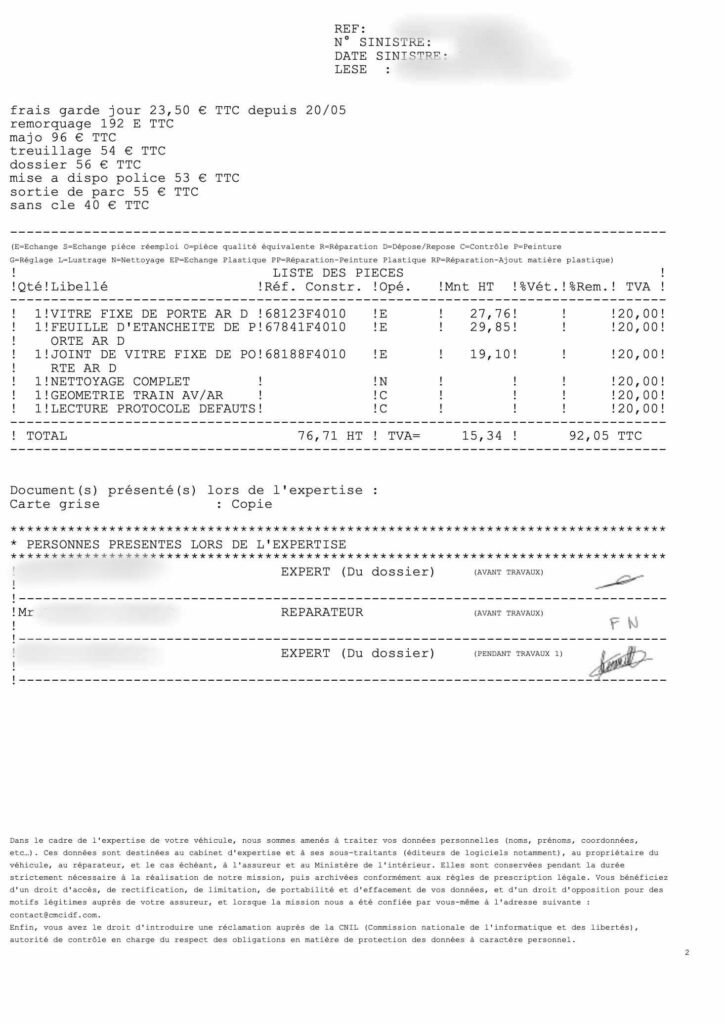

- GPS navigation module not detected.

- The USB port is not functional.

- The operating system is on a basic version (Touch 2 without Go Plus).

- There are traces of disassembly on the steering wheel.

The front body shows traces of impacts that could be related to the vehicle’s movement during the theft, towing, or while being transported to the scrapyard.

We are still waiting for the Toyota diagnostics to understand why the GPS is not being detected. It could be due to the thief disabling it using specialized equipment or simply disconnecting it.

If the GPS module was stolen, it does seem strange that everything else was reassembled in the car.

What is the problem with L’Olivier Assurance ?

One of the major issues with L’Olivier is the impossibility for the client to reach the claims handler. I imagine that the claims handler is not even reachable by the expert either. This means that an expert can take one or two weeks, or even a month, to respond to you, and there’s nothing you can do about it.

Additionally, the procedure for vehicles that are found drivable seems to be non-existent, even though it is a fairly common possibility nowadays. We believe that repairing a window and performing a diagnostic can be done in an afternoon.

Of course, like with the majority of insurance companies, this company tends to favor its own interests.

It’s not a real insurance. The only service we received from them was from Europ Assistance.

You are left to fend for yourself and have to do the work of the insurance company by contacting and following up with them every day.

No deadlines are respected. A simple expertise report on a vehicle with a broken window can take more than two months.

In short, this insurer is only here to take your money and give you nothing in return.

Their experts are biased and poorly qualified. They work indirectly for the insurance company, which continues their contract on the condition that they rule in their favor.

What are the remedies?

The two parties involved are passing the buck, and in the meantime, we are left without a vehicle, and our car has a broken window where rain is getting in, and the components are subject to corrosion.

Our neighbors advised us not to take the car back, but we don’t want to prolong our wait with the reimbursement process and have to call the insurance company every week.

The only recourse left is to seek the assistance of a business lawyer. L’Olivier Assurance had a rare customer willing to retrieve a stolen vehicle instead of demanding compensation. Instead of repairing it promptly, they decided to avoid any means of resuming the contract and stopped responding altogether.

What about Toyota ?

I believe that Toyota also bears some responsibility for the fact that the vehicle can be easily started using a JBL Bluetooth speaker, which is sold for 1000 euros online.

In addition to this vulnerability, the garages are flooded with recovered vehicles, and the insurance companies with their delays and complexities make life impossible for these garages as well. The Livry-Gargan Toyota garage outright refused to take my vehicle, even though mid-July availability was possible.

Imagine buying a car, falling victim to a manufacturer’s flaw, and then being denied repairs by the same manufacturer once the vehicle is recovered by the police.

Verdict

0 sur 10.

To be avoided, plain and simple. If you’re looking for something other than an insurer that promises coverage in 15 minutes at a higher price than the competition and delivers absolutely nothing in return—less than the bare minimum in terms of service—then steer clear of this company.

This company is on the verge of being a scam. Once you have a claim, no one will contact you to guide you through the process; you’ll have to handle all the procedures yourself.

Your contract will automatically terminate 30 days after the theft.

The VRADE (Estimated Value of Vehicle After Damage) is calculated by biased experts who favor the insurer. It takes 2 months for an expert to validate a report on a vehicle with a broken window.

Even when you receive an email response from the claims handler stating that after almost two months, the repairs will not be covered, they don’t even guide you on retrieving your vehicle.

Simply the worst possible experience, Avoid at all costs.

Summary of events:

Vehicle stolen on 19/03/23

Mileage at 38058 km

Initial Estimated Value of Vehicle After Damage (VRADE) offered at 19990 euros on 03/05/23

Final VRADE offer at 21000 euros on 09/05/23, rejected as the current market value is around 23000 euros on Leboncoin (a classified ads website)

Vehicle found on 20/05/23

Mileage at 38091 km (+33 km)

Rear right deflector broken

Glove compartment dismantled to start the car via OBD (On-Board Diagnostics)

VIN (Vehicle Identification Number) stolen under the windshield (not noted by the expert)

Towed and stored by MDR – Dépannfirst La Rochette 77000

Initial expert assessment on 25/05/23:

Technically and economically repairable, signs of forced entry to access the interior, further inspection needed after vehicle is transferred to the network

Assured informed of ongoing costs at the storage facility

Urgent request for vehicle transfer

Provisional report: Total cost including taxes: 512.05 euros

Vehicle moved to the insurance partner’s location to avoid storage costs on 02/06/23

Personal belongings retrieved from Recycle Auto Pièces on 05/06/23 (child seat and stroller)

Broken window not covered and vehicle not secured (doors and hood unlocked)

VIN missing under the windshield, glove compartment dismantled

Vehicle not yet cleaned

Still awaiting the final report for repairs on 25/06/23

If repair cost is below the deductible, they won’t cover the repairs

Final report on 27/06/23

shows cost below the deductible at 512.05 euros, deductible is 605 euros

On 25/07/23,

Damage to the bumper

GPS not detected, cracked license plate support

Non-functional USB port

Missing VIN under the windshield.

GIPHY App Key not set. Please check settings